“I may have been early, but I’m not wrong.” How the ‘07-’08 U.S. housing market collapse resembles the next-gen materials movement

One man places an unlikely bet. What follows? A tense waiting game in a defiant market. Years pass until, finally, he’s vindicated.

If you think this sounds like a movie plot, you’re right. It’s the storyline to The Big Short, based on a true story, where investor Michael Burry predicted (and benefited from) the U.S. housing market crash.

But it’s also a story that Veshin Factory’s Joey Pringle finds himself in the middle of. One where a only handful of visionaries are going against all odds and betting against the popular option.

And if history’s anything to go by, you can probably predict the ending to this one too—it’s one that should redefine an entire industry.

The question is, when?

Michael Burry: Betting against the “stable” option

In 2007-08, the U.S. housing market bubble burst, creating an economic crisis that rocked the world. Few saw it coming. And one of those was hedge fund manager, Michael Burry.

Burry’s industry knowledge gave him an insight no one else had—that the market was about to be turned on its head. So, in a controversial move, he bet against it, risking billions in his company and his clients’ investments.

And then, he waited. Patiently at first. And then in complete bafflement. Because while Burry’s timeline came and went, the crash he’d foreseen didn’t.

A system on life support

Rather than collapsing right on schedule, the market didn’t behave as predicted. Big banks poured even more money into the broken system, keeping it afloat.

So, he did what any visionary would do: battened down the hatches.

He committed his employer’s firm—which would burn through billions of dollars—to a tense wait of over two years. Investors demanded results. And when these didn’t materialise, they demanded refunds.

The bubble bursts

But Burry held his nerve. Until 2007, when the cracks ripped open. Two major hedge funds failed, panic set in, global financial services collapsed. And the market crashed.

Burry had been right all along. He and those clients that stuck with him till the end pocketed millions, while the rest of the world was left to pick up the pieces.

Joey Pringle: Anticipating the launch of next-gen materials

This is where Joey Pringle comes in. Just as Burry bet against the housing market, Joey’s betting on a huge industry shakeup up. This time, in fashion, where next-gen materials catapult into the mainstream.

It’s high stakes. All Joey’s eggs are in one basket and he’s in for the long wait. Because, just like the movie, the change he’s betting on isn’t happening quick enough.

You’ve got to wonder, why not? There’s a growing demand for more sustainable options among consumers, while there’s no doubt brands are interested in alternative materials. Not to mention the billions of dollars that have been invested.

For Joey, it's baffling. Like Burry, he’s watching the industry closely, waiting for something to happen. “I’m thinking we should have been using next-gen materials by now on a large, commercial scale. They’re available and scaling up is possible.”

As Joey watches, waiting for the world to catch up, the question looms large: why isn't the next-gen alternative leather industry taking off as quickly as he thought?

Financial, technical, and compliance bottlenecks

For starters, the financial landscape has been bleak. In the Material Innovation Initiative’s (MII) State of the Industry Report 2022 Nicole Rawling, Co-founder & CEO, suggested economic challenges would lead to “more companies closing their doors than any other year.”

That would have tightened the noose around the neck of innovation, especially for smaller ventures already struggling to stay afloat.

Technical challenges create further complications. Because as with any new material development, innovators are figuring out how to solve issues like microbubbles, colour inconsistency, and durability.

Eliminating the use of PU—a performance enhancer in current synthetic leathers—adds another layer of complexity. And investors, wary of these technical hurdles, are hesitant.

But their funding is critical for research and development, especially in an industry redefining decades-old practices. This has led to a deadlock—brands seek market-ready materials at competitive prices, while innovators need partnerships to meet demands.

Fears of greenwashing impact innovation

Sustainability regulations are becoming stricter, while the media—for good or for bad—is laser-focused on sustainability claims.

To avoid being caught out, companies need a profound understanding of their product's life cycle. And this can be challenging when companies are still working out the kinks in order to scale up.

What’s also key is knowing how to describe the product. Making claims like “sustainable,” “green,” or “eco-friendly” without the data to back them up is playing with fire. Portugal has even banned the term “vegan leather” for being misleading.

Meanwhile, the debate around what is “more sustainable”—animal leather or plastic-based—materials rages on.

Ongoing controversy like this detracts attention from innovation, casting suspicion over the industry. And with stakeholders’ trust at fragile levels, it’s easy to see why innovators may wish to hide in the crowd.

Bolt Threads: the canary in the coal mine?

Bolt Threads' experience with MYLO is the industry’s cautionary tale.

It was a promising venture, sparking collaborations with brands like Stella McCartney and adidas. But despite securing $300 million in investments, they couldn’t raise the capital needed to bring the material to scale.

The production of MYLO is currently on pause. And these shockwaves have rippled through an already nervous industry, deterring others from making their own bold moves.

It’s a stark reminder of the challenges in pioneering new sustainable materials. What the industry really needed was a success story. One that instilled confidence and secured new investments.

“Bringing low impact innovative materials to market is increasingly difficult and desperately needed.”

Dan Widmaier, co-founder and CEO, Bolt Threads

The slow, shifting sands of a more sustainable movement

But like Burry, Joey remains optimistic. And his confidence isn't unfounded, with "so much investment going in, it has to happen soon."

He himself sees parallels with Burry’s story, predicting, "in the next three years, what happens in the film will happen in our industry."

Dig a little deeper and you’ll see that Joey’s right. There’s already increased engagement from material manufacturers, fashion conglomerates, and automakers. In fact, last year the MII reported that 90% of leading fashion brands are exploring next-gen materials for new product development.

The thing is, because many innovators prefer to stay in 'stealth mode' until they feel ready to launch publicly. So much of this progress stays under the radar.

“We will see more brand experimentations with next-gen materials. It will move from hype to normal over the next five years.”

— Thomasine Dolan, Director of Materials & Design Innovation, MII

Despite what looks like slow progress, next-gen materials seem to be on a similar trajectory to that of alternative proteins. “We see the next-gen materials industry as five to ten years behind alt proteins, with the wholesale market size expected to reach $2.2 billion (USD) by 2026,” claims MII’s Elaine Siu.

We’ll also see costs come down as material suppliers scale up. Even with the unfortunate case of Bolt Thread’s MYLO being put on pause, scaling up is happening.

Take Natural Fiber Welding’s (NFW) partnership with IPCO, which will soon make their plant-based, low-carbon, plastic-free MIRUM® available on 1.6 metre-wide rolls. This will mean better costs and utilisation in production, making adoption easier.

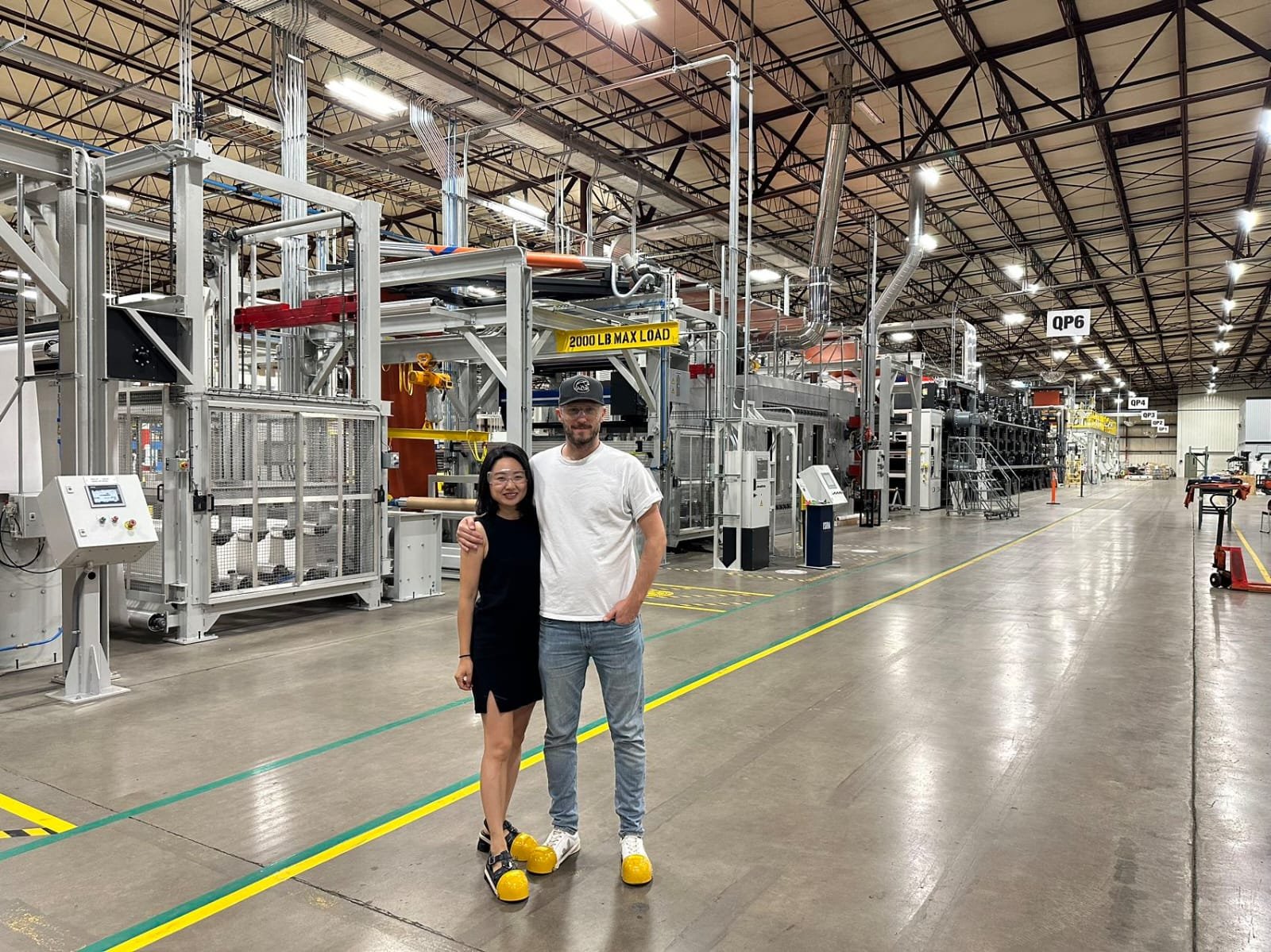

Joey Pringle and Xiao Wei, Founder and Co-Owner of Veshin Factory respectively, see NFW and IPCOs partnership in action at their manufacturing centre, in Peoria, Illinois.

The big short and the long wait

If there’s anything to be learned here, it’s that transformation takes time. It tests the mettle of even the most passionate visionaries.

And Joey knows this all too well, saying "We know Rome wasn't built in a day, we know the setbacks that have happened, but we’re all confident in the big picture—it’s just like the movie.”

And despite the uncertain timeline, transformation is within reach. Navigating these uncharted waters isn’t for the faint-hearted. But in this waiting game, those who dare to envision, invest, and prepare for the future are the ones who will see it come to fruition, and shape it.

“I may have been early, but I’m not wrong.”

— Michael Burry, The Big Short, directed by Adam McKay, 2015.